UAE Real Estate Market Review Q2 2024

The UAE’s GDP is projected to grow by 3.8% in 2024, slightly lower than the 3.9% forecast in the previous quarter.

In Dubai’s occupier market, leasing activity surged significantly during Q2 2024, with rental registrations rising by 38.4% year-on-year, totaling 41,495.

Abu Dhabi’s office market saw notable improvements in rental performance due to increased absorption rates. In Q2 2024, average rents in the Prime, Grade A, and Grade B segments grew by 9.1%, 7.4%, and 14.5%, respectively, compared to the previous year.

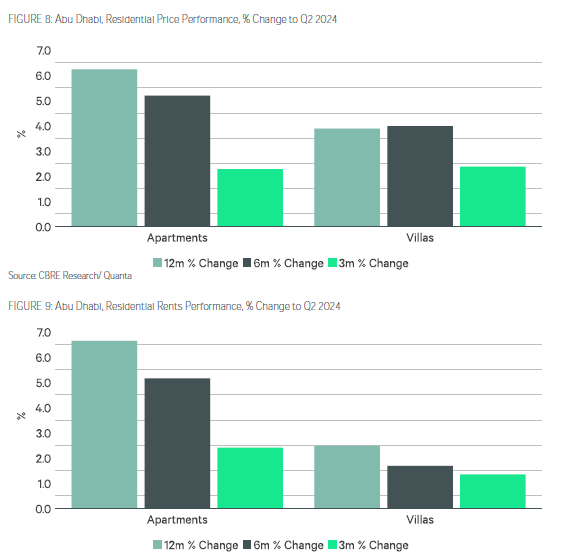

Residential property prices in Abu Dhabi also showed growth during Q2 2024, with average apartment prices increasing by 6.2% year-on-year and villa prices rising by 3.9%.

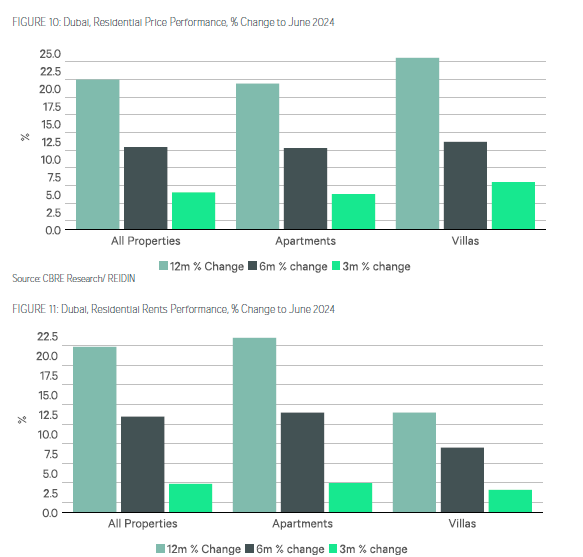

Dubai’s residential market continued its strong performance. By June 2024, average property prices rose by 21.3% compared to the previous year, driven by a 20.7% increase in apartment prices and a 24.3% rise in villa prices.

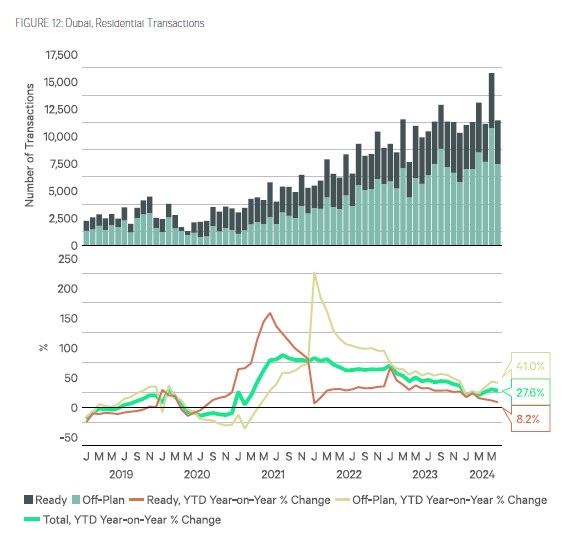

Residential transactions in Dubai reached a record-breaking 73,618 in the first half of 2024, reflecting a 27.6% year-on-year increase. Off-plan sales grew by 41.0%, while secondary market sales rose by 8.2%.

The UAE’s hospitality sector remained robust, supported by high visitor levels. By June 2024, the country’s average occupancy rate increased by 1.7 percentage points year-on-year.

Retail rental performance also remained strong in both Abu Dhabi and Dubai. In Q2 2024, Abu Dhabi’s average retail rents grew by 3.6%, while Dubai saw a 6.0% increase over the same period.

The industrial and logistics sector experienced solid growth. In Q2 2024, average rents in Abu Dhabi rose by 4.7% year-on-year, while Dubai recorded a 10.6% increase.

These figures highlight the UAE’s dynamic real estate market and its continued appeal across various sectors.

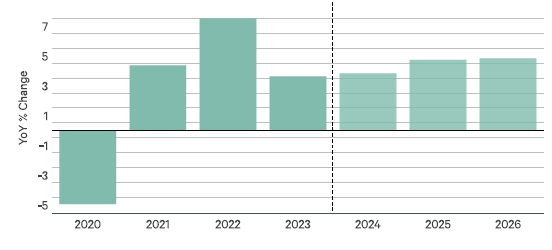

The below graph illustrates the year-on-year (YoY) percentage change in GDP growth from 2020 to 2026. Here’s an explanation based on the data:

- 2020: The GDP contracted by approximately 5%, reflecting the economic impact of the global COVID-19 pandemic.

- 2021: A recovery began with positive growth, showing a rebound from the previous year’s decline.

- 2022: Growth peaked at around 7%, indicating a strong economic resurgence, likely fueled by increased activity and post-pandemic recovery.

- 2023: Growth moderated to around 3%, stabilizing after the sharp rebound in 2022.

- 2024-2026 (Forecast): The GDP is projected to grow consistently at approximately 3-4% annually, reflecting a stable and sustainable economic trajectory.

This graph highlights the UAE’s resilience and recovery, with a strong rebound post-pandemic and steady growth in the forecasted years.

In Q2 2024, Abu Dhabi recorded 2,108 residential sales transactions, reflecting a significant 22.8% decline compared to the same period last year. This decrease was largely driven by a sharp 41.9% drop in off-plan transactions, while secondary market transactions surged by 38.7%. For the first half of the year, the total transaction volume reached 5,104, marking a modest 1.8% increase year-on-year. During this period, secondary market sales grew by 38.7%, offsetting a 10.7% decline in off-plan sales.

Residential Price Performance

- Apartments:

- Over the past 12 months, apartment prices increased by approximately 6%.

- Over the last 6 months, the growth slowed to around 4%.

- Over the past 3 months, growth was more modest, around 2%.

- Villas:

- Villa prices showed a 12-month increase of approximately 4%.

- Over the past 6 months, villa prices remained stable, with similar growth as the 12-month trend.

- Over the past 3 months, growth slightly tapered off to around 2%.

Residential Rents Performance

- Apartments:

- Rental prices for apartments rose sharply by about 6% over the past year.

- In the last 6 months, rental growth remained strong at around 5%.

- Over the past 3 months, growth slowed to roughly 2%.

- Villas:

- Villa rental rates increased by about 4% over the past 12 months.

- Growth over the last 6 months was consistent with the 12-month trend.

- Over the last 3 months, villa rental growth was more subdued, around 1-2%.

Key Insights:

- Apartments consistently outperformed villas in both price and rental growth, indicating stronger demand in this segment.

- Growth rates are higher over longer periods (12 months), but the pace has moderated over the last 3 and 6 months.

- Villas experienced steadier growth but at a slower rate compared to apartments, reflecting a more stable demand.

This data highlights a robust residential market in Abu Dhabi, with apartment demand driving much of the growth in both prices and rents.

As of June 2024, average property prices in Dubai experienced a 21.3% year-on-year increase, up from 20.1% growth recorded the previous month. This rise was driven by a 20.7% increase in average apartment prices and a 24.3% surge in average villa prices. Average prices per square foot reached AED 1,561 for apartments and AED 1,896 for villas. Palm Jumeirah recorded the highest sales rates per square foot, with apartments averaging AED 2,831 and villas reaching AED 5,153.

Residential rents also saw substantial growth, with average rents rising by 21.1% year-on-year as of June 2024. This increase was fueled by a 22.2% growth in apartment rents and a 12.7% rise in villa rents. Average annual rents stood at AED 127,969 for apartments and AED 354,512 for villas. Palm Jumeirah registered the highest apartment rents at an average of AED 279,826 per year, while Al Barari recorded the highest villa rents, averaging AED 1,344,844 annually.

According to data from the Dubai Land Department, 299,564 rental contracts were registered in the first half of 2024, reflecting a 52.5% increase compared to 2019 and a 5.8% rise from the same period in 2023. This year-on-year growth was primarily driven by an 11.9% increase in renewed contracts, while new registrations declined by 3.7%. This trend highlights tenants’ preference to renew existing leases to avoid significantly higher costs associated with leasing new units.

On the supply side, 12,249 residential units were delivered in Dubai during the first half of 2024, with 44.4% of these completions concentrated in Meydan One, Al Furjan, and Jumeirah Village Circle. Looking ahead, 40,582 units are scheduled for delivery in the second half of the year, with 29.9% expected to be completed in District Seven, Business Bay, and Damac Lagoons. However, based on historical trends, some of these completions are likely to be deferred to the following year.

Dubai Residential Transactions

By June 2024, average prices in Dubai had increased by 21.3% compared to the previous year, up from 20.1% growth recorded a month earlier. This rise was driven by a 20.7% increase in average apartment prices and a 24.3% increase in average villa prices. As of June 2024, average apartment and villa prices stood at AED 1,561 and AED 1,896 per square foot, respectively. Palm Jumeirah recorded the highest sales rates per square foot in both the apartment and villa segments, with average rates of AED 2,831 and AED 5,153, respectively.

Rental growth remained steady, with average residential rents rising by 21.1% year-on-year to June 2024. This increase was fueled by a 22.2% rise in average apartment rents and a 12.7% increase in average villa rents. By June 2024, average apartment and villa rents were AED 127,969 and AED 354,512 per annum, respectively. The highest annual rents for apartments and villas were found in Palm Jumeirah (AED 279,826) and Al Barari (AED 1,344,844).

According to the Dubai Land Department, 299,564 rental contracts were registered in the first half of 2024, reflecting a 52.5% increase from 2019 and a 5.8% rise from the same period in 2023. This growth was primarily driven by an 11.9% increase in renewed contracts, while new registrations declined by 3.7%, as tenants continued to opt for lease renewals to avoid higher rental costs.

On the supply side, 12,249 units were delivered in Dubai in the first half of 2024, with 44.4% of these units completed in Meydan One, Al Furjan, and Jumeirah Village Circle. In the second half of the year, 40,582 units are expected to be delivered, with 29.9% of this new stock slated for completion in District Seven, Business Bay, and Damac Lagoons. However, some of these completions may be delayed into the following year, in line with historical trends.

Residential transactions in Dubai increased by 15.8% year-on-year as of June 2024, driven by a 31.9% rise in off-plan transactions, while secondary market transactions declined by 5.4%. In the first half of 2024, Dubai recorded 73,618 residential transactions, the highest on record for this period, reflecting a 27.6% year-on-year increase. Off-plan sales grew by 41.0%, while secondary market sales rose by 8.2%.

Sales of properties priced above AED 5 million and AED 10 million also surged, totaling 5,727 and 2,014 transactions, respectively, with year-on-year increases of 22.5% and 41.5%. Off-plan sales dominated these segments, accounting for 63.1% and 65.5% of transactions. However, in traditional prime and super-prime locations, sales activity slowed due to limited inventory. Prime market transactions declined by 11.7% to 919, while super-prime transactions fell by 18.9% to 454 in the first half of 2024.

Average prices in the prime segment rose by 13.8% year-on-year to AED 4,784 per square foot, while super-prime prices increased by 13.4% to AED 5,127 per square foot as of Q2 2024. Although sales and rental rates continue to rise, the pace of growth has moderated, indicating market stability. During the first half of 2024, 88.1% of sales listings and 73.8% of rental listings remained unchanged, compared to 79.6% and 72.9% in the same period last year.